W9 Form 2024 Irs Penalties. This form must be filled out in order to receive payment from companies that you do business with. The irs charges penalties for inaccurate information, too.

It translates to a top 14.4% rate for those earning over $1 million. If you make a false statement with no reasonable basis that results in no backup.

Depending On How Much And How They Get Paid By The Platform, Either.

The irs charges penalties for inaccurate information, too.

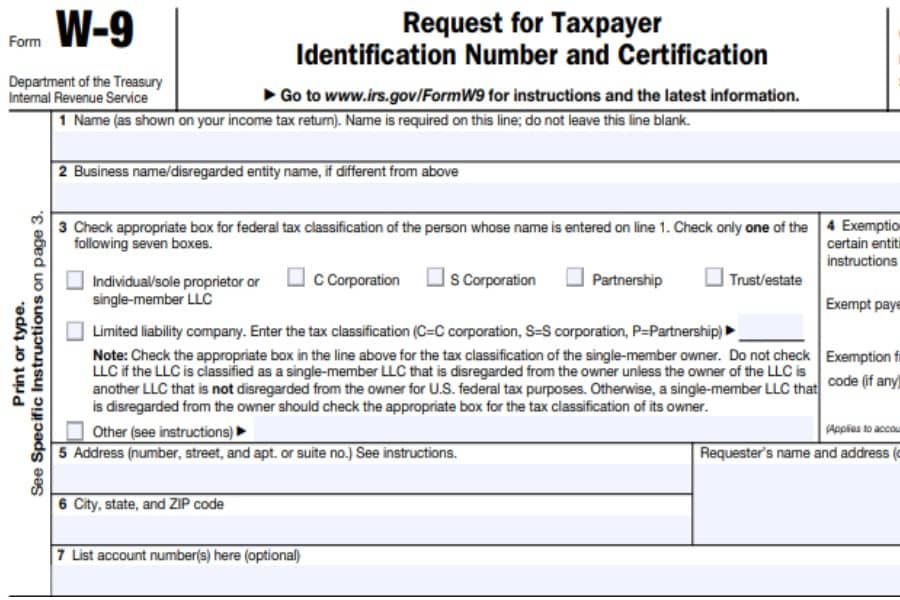

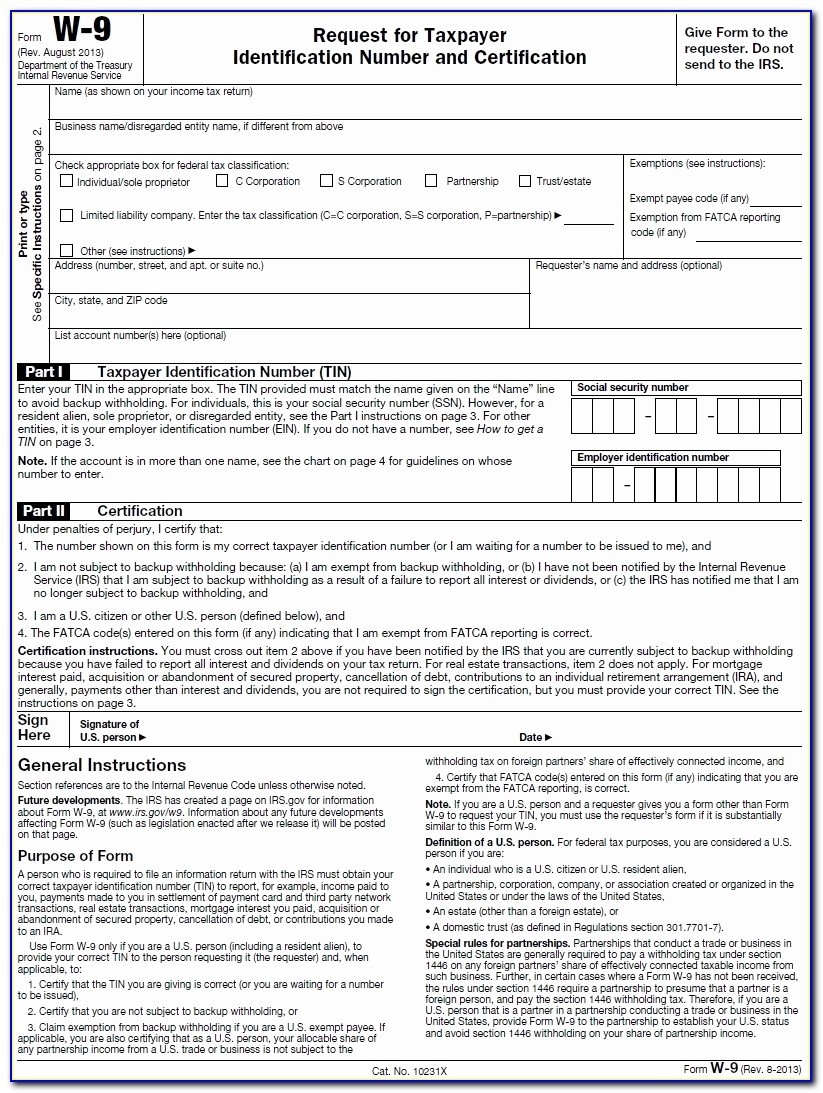

The Original Line 3—Federal Tax Classification Has Now Been Split Into Two Sections, Line 3A And Line 3B.

An indiana cpa pleaded guilty yesterday to assisting in the preparation of false tax returns on behalf of clients who participated in an illegal tax shelter.

W9 Form 2024 Irs Penalties Images References :

Source: olympiewalma.pages.dev

Source: olympiewalma.pages.dev

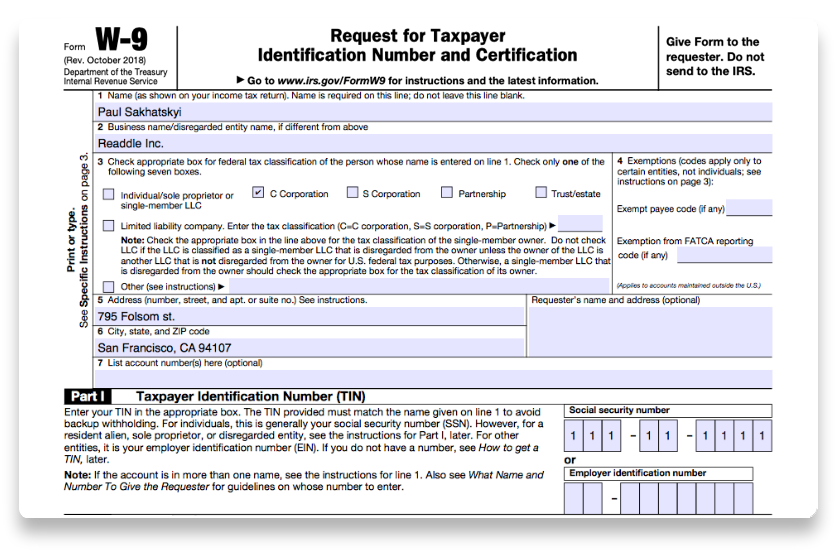

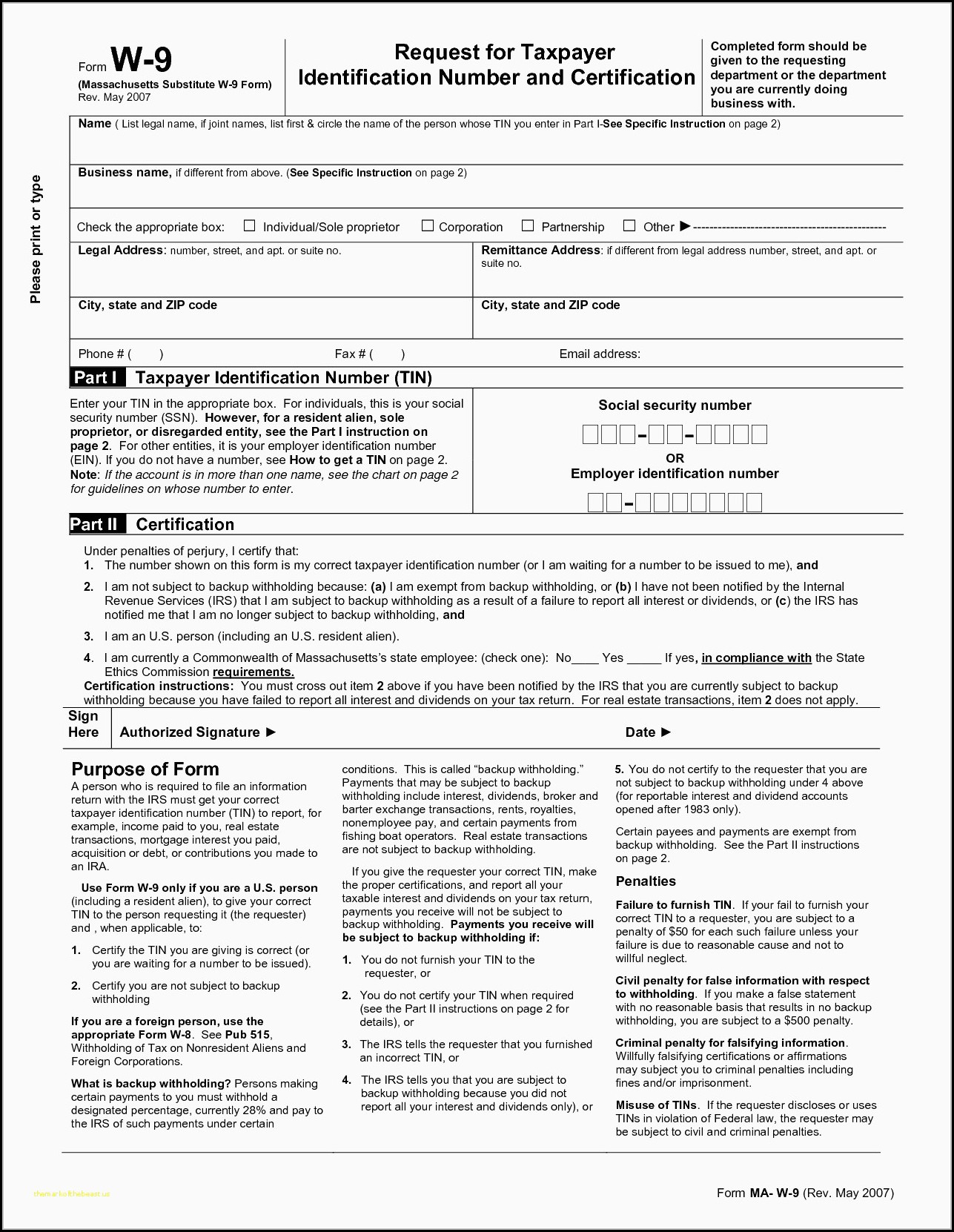

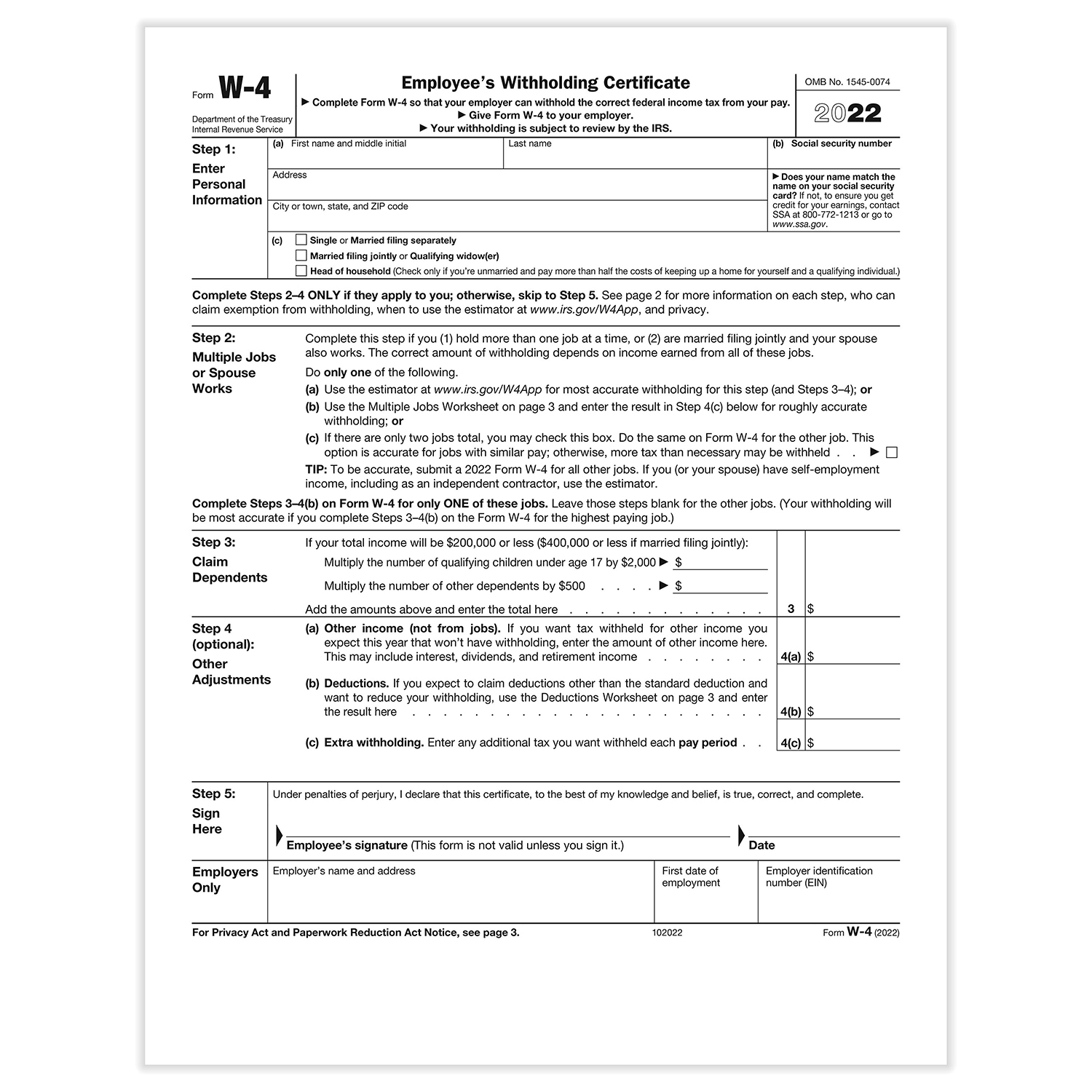

W9 Form 2024 Irs Request Jany Roanne, This form is used to report payments made to you to the irs, and failing to file. The irs imposes a $50 penalty for each failure to provide a correct taxpayer identification number (tin).

Source: doriseqtamarah.pages.dev

Source: doriseqtamarah.pages.dev

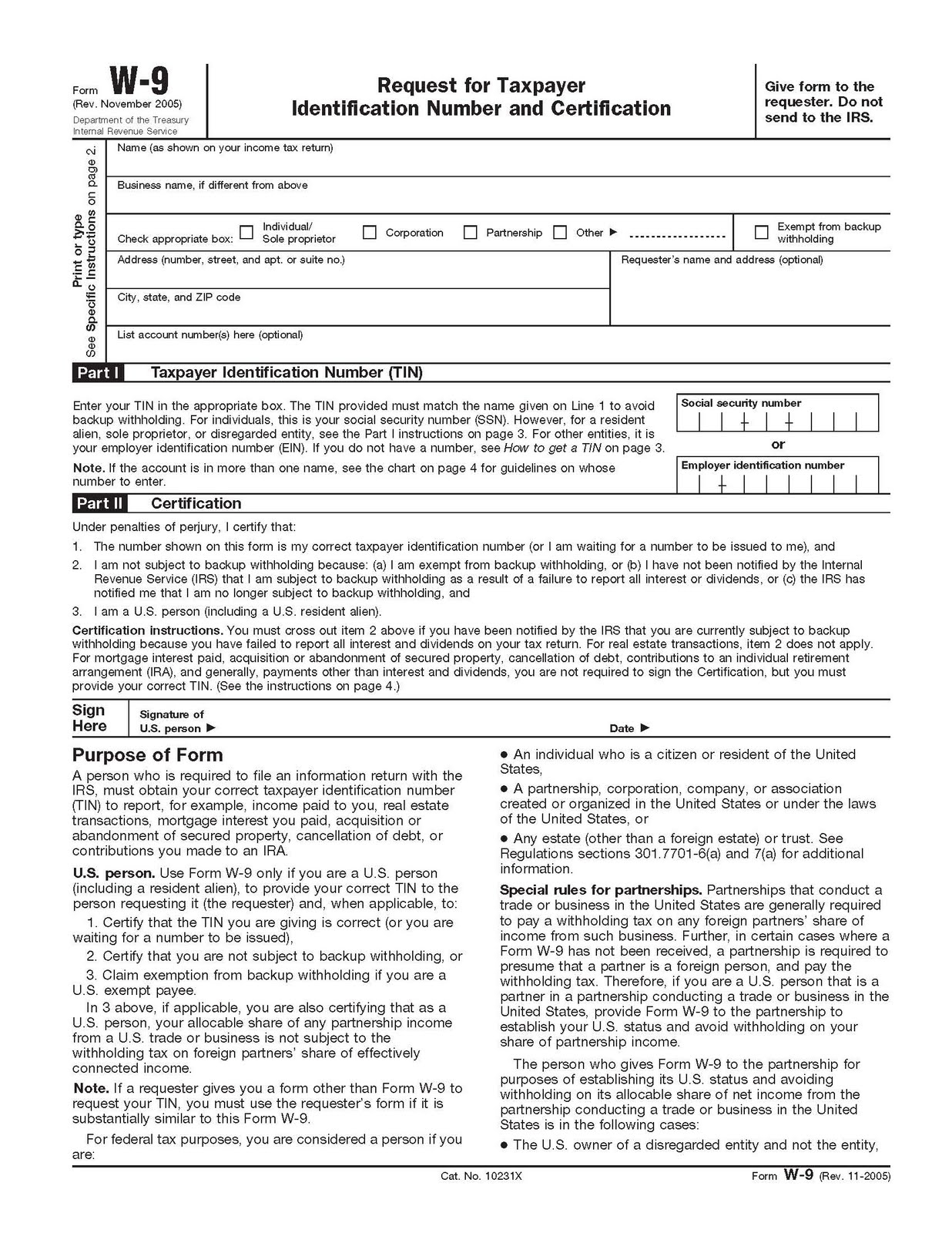

W9 Form 2024 Free Printable Pdf Elna Noelyn, The 2024 version replaces the version that was previously published by the irs in 2018. The irs charges penalties for inaccurate information, too.

Source: drusiqkarita.pages.dev

Source: drusiqkarita.pages.dev

W9 Form 2024 Irs Pdf Casie Stoddard, The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b. An indiana cpa pleaded guilty yesterday to assisting in the preparation of false tax returns on behalf of clients who participated in an illegal tax shelter.

Source: lorellewleona.pages.dev

Source: lorellewleona.pages.dev

Free Printable W9 Form 2024 Rea Damaris, If you make a false statement with no reasonable basis that results in no backup. The latest versions of irs forms, instructions, and publications.

Source: jerrilynwdaisie.pages.dev

Source: jerrilynwdaisie.pages.dev

W9 Tax Form 2024 Pdf Vonni Johannah, Not filling out a w9 form can also result in penalties. The irs imposes a $50 penalty for each failure to provide a correct taxpayer identification number (tin).

Source: www.printableform.net

Source: www.printableform.net

W9 Form 2021 Printable Printable Form 2024, Modification of line 3a to clarify. The w9 tax form 2024 is used to provide correct taxpayer identification numbers, addresses, and names, mainly for freelancers and independent contractors.

Source: perryqagnesse.pages.dev

Source: perryqagnesse.pages.dev

W9 Printable Form 2024 Amata Bethina, The new initiative involves more than 25,000 people with more than $1 million in income, and over. Following these steps will protect you from irs penalties.

Source: rodieqjuieta.pages.dev

Source: rodieqjuieta.pages.dev

W9 2024 Fillable Irs Joete Madelin, Start free file fillable forms. The latest versions of irs forms, instructions, and publications.

Source: amebtierney.pages.dev

Source: amebtierney.pages.dev

Free W9 Form 2024 Irs Irena Leodora, According to court documents and statements made. The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Irs Form W 9 Printable, The penalty for not furnishing a tin is $50 per occurrence unless it’s a case of reasonable cause rather than willful neglect. The new initiative involves more than 25,000 people with more than $1 million in income, and over.

You Must Create A New Account Each Year.

Not filling out a w9 form can also result in penalties.

The Latest Versions Of Irs Forms, Instructions, And Publications.

Start free file fillable forms.

Posted in 2024